Online finance for any type of car – put in the figures and see for yourself

Tag Archives: money

One in five new retirees will have debts taking nearly a decade to pay off

Almost one in five (19 per cent) of those planning to retire this year will do so with debts outstanding, averaging £21,800, according to new research from Prudential.

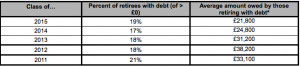

The insurer’s ‘Class of’ research into the future plans, finances and aspirations of those planning to retire in the next 12 months is now in its eighth year. This year’s results show that the ‘Class of 2015’ are more likely to retire in debt than those who gave up work last year – (17 per cent of those retiring in 2014 said they would have debts outstanding when they retired, compared with 19 per cent this year).

Prudential’s research has tracked retiree debt since 2011 and shows that despite some small fluctuations, the proportion of those retiring with debts outstanding has remained consistently around the one in five mark. There is a noticeable trend though that retirees’ average amount of debt has reduced over the years.

Those retiring with debts in 2015 say they will owe on average £16,400 less than those who retired in 2012 – representing an encouraging 43 per cent drop in the last three years (see table below).

The average ‘Class of 2015’ retiree with debts says that it will be just over three years before they are paid off – this also compares favourably with last year’s retirees who said it would take them four years. Meanwhile, almost one in 10 (nine per cent) of this year’s retirees with debts expect to take nine or more years to clear their debts, and a further five per cent believe they will never pay them off.

More than two in five (43 per cent) of this year’s retirees with debts have an outstanding mortgage – another figure that has remained stubbornly high since its peak at 52 per cent in 2011. Over a half (55 per cent) will have credit card debts.

On average, a female retiree with debts will owe £24,900 this year – up considerably since last year when the average owed was £20,700. Men retiring this year with debts will owe an average of £19,700, down significantly from last year’s £28,400.

The proportion of women expecting to be in debt when they retire is unchanged at 16 per cent, while the proportion of men who expect to have debts is slightly higher at 21 per cent compared with 19 per cent last year.

While the ‘Class of 2015’ have the highest expected annual retirement income for six years at £17,000 a year, debts remain a major drain on their finances. On average, debt repayments are currently costing them more than £200 a month, rising to over £500 a month for one in seven (14 per cent).

Stan Russell, a retirement expert at Prudential, said: “Our new research shows a welcome downward trend in the average amount of debt for people retiring this year. However, it is a concern that the proportion of people reaching the retirement milestone still owing money is refusing to fall.

For many, retirement is a time in life when it is necessary to re-assess household budgets, and any debts outstanding will inevitably make this job more difficult. A consultation with a financial adviser or retirement specialist can help people to get their finances ready for life after work.

“Debt does not have to be a major issue in retirement though, as long as people have a realistic repayment plan in place. Citizens Advice Bureaux can provide free help on managing and paying off debt, and the Pensions Advisory Service can help with retirement income planning and related issues.”

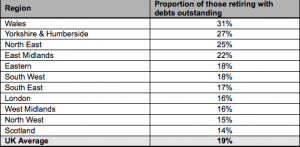

Regional breakdown

Retiring in debt

In response to the following question:

“Approximately how much personal debt do you think you will have at the point you retire?”

Brain’s desire for ‘instant gratification’ can wreck future finances

Most of us prefer to the thrill of buying now rather than saving and safeguarding our financial future, according to new research from the Skipton Building Society.

But it may not be all our fault as our brains are not programmed to behave in our own best interests when it comes to money.

As part of a campaign to get under the skin of the nation’s retirees, it’s been revealed this week, by Skipton Building Society, that our brains could have a lot to answer for, when it comes to the nation’s lack of preparedness for retirement.

• Over 50% feel unprepared for retirement 10-15 years out

• 30% have no idea how much is in their pension pot

• Physiological testing illustrates people confused about their futures

• Desire for immediate gratification creates barrier to financial planning

• Our brains need to be retrained to create stronger financial futures

As part of their DNA of Retirement research undertaken earlier this month, (which is believed to be a first for UK financial services) physiological responses were explored to provide a 360 degree insight into hopes and fears surrounding retirement and financial planning for our futures.*

It was revealed that over 50% were feeling unprepared for retirement at 10 to 15 years out, with 30% having no idea how much money is in their pension pot. Worryingly, nearly a quarter of people revealed they don’t have a retirement plan. Overall, anxiety was evident as nearly two thirds of retirees lacked the confidence that they are financially prepared for their retirement.

In follow up, Skipton, the UK’s fourth largest building society, has been working with leading neuroscience consultant and published author of best selling book‘Sort your Brain Out’, Dr Jack Lewis. Together, they can now reveal further insights from the analysis of the research data, which shows that our neurological programming could be a huge stumbling block in our pension planning.

Dr Jack said: “Our brains are not designed to ensure we are financially prepared for the future. In today’s fast paced world our brain is still tuned into instincts honed several millennia ago which encourage us to seek immediate gratification. If I offered a room of people £100 cash today, or £150 cash in a month, the majority would take the “safe” instant £100. This is because our brains are biased in favour of any decisions that give us a quick return. Of course, if we allow every financial decision we make to fall into the ‘live for the moment’ trap – then clearly the nation’s financial preparedness for retirement will be in a dire state.”

This is accentuated even further if we are not clear what our futures look like and confusion around our vision was also a key finding of the DNA of Retirement research. Most people, when questioned, described clear and inspired plans, covering aspirations from wing walking to starting new businesses. However, 64% of people’s physiological responses contradicted their stated desires. For example, what they said they wanted and what their subconscious revealed they wanted were different things.

Other findings of the research were that a significant proportion of the respondents were very aspirational about their futures, and the aspirations they had for retirement were quite elaborate. However, it didn’t appear that these dreams were matched by financial preparedness, thus illustrating a HUGE risk in terms of financial stability of our futures.

Dr Jack added: “The brain is a complex organ. We can shape it and mould it according to any behaviour that we regularly, intensively and consistently perform. However one critical step that is often overlooked is the need to consciously steer ourselves towards behaviours that yield the best return in the long run. As a general rule we tend not to care much for the best interests of our future selves. It is important to spend time vividly imagining the big picture to focus our mind on long term goals. If we never take the time to think about what kind of lifestyle we want to be living in retirement, then we simply have nothing to set our sights on. Asking people to financially plan for something that their brain is not emotionally engaged by is a big ask when we have so many immediate financial concerns. We can re-wire our brains by adopting new habits but to do this we first need to subtly alter our behaviours, beliefs, and motivations according to the best interests of our future selves.”

As part of their commitment to supporting people in and approaching retirement Skipton has launched a free Retirement Review** service in all branches nationwide, where people can call in and have a chat with a financial advisor to help them start to picture what kind of retirement they want, to then help them plan for it. They are also developing a persona app to help people visualise their future based on their own personal Retirement DNA, which will be rolled out in branch in the coming months.

David Cutter Group Chief Executive of Skipton Building Society, said: “Our research has revealed some worrying trends – we cannot have a country bursting with aspiration whose hopes will then be struck down by apathy or aversion to financial planning.

“As a mutual, we were established 161 years ago to help tackle the prevalent social issue of the time – helping ordinary people to build their own homes. Through our new retirement service, we’re bringing this ethos bang up to date by tackling THE financial issue of today.”

Skipton, the UK’s fourth largest building society, is keen to gain a true understanding of people’s retirement wishes, in order to be able to help them realise their goals, in line with its new Retirement Service.Skipton is currently offering a free will for anyone who has a free Retirement Review in any of its branches.

Half of couples risk leaving partners without income

Almost half of couples over the age of 40 have failed to make financial arrangements to ensure that their other halves will continue to receive an income on the death of their partner

Nearly 1 in 5 women plan to rely on their partners’ retirement savings

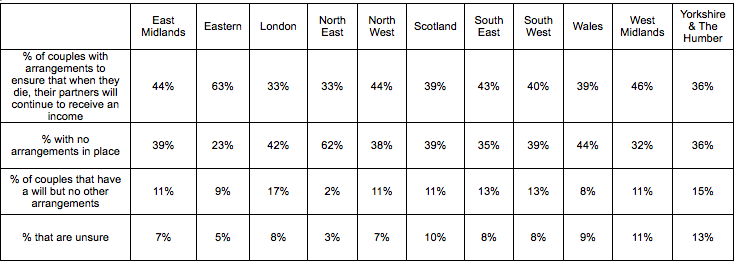

Just two in five (42 per cent) couples over the age of 40 in the UK have made arrangements to ensure that one partner will continue to receive a retirement income after the other dies, according to new research from Prudential1.

Almost half of couples over the age of 40 have failed to make financial arrangements to make sure that their other halves will continue to receive an income on the death of their partner

Women are most at risk, with nearly one in five (18 per cent) planning to depend entirely on their other halves for their retirement incomes, compared with just two per cent of men.

The insurer’s annual Couples’ Conversations study, which provides insights into the finances of co-habiting couples over the age of 40, also found that joint retirement planning discussions have declined over the past twelve months.

Nearly half (47 per cent) of couples have never discussed the impact that one partner’s death could have on their current pension arrangements – a 13 per cent increase since last year.

Couples in the North East are the least likely to have made joint retirement arrangements. Almost two thirds of couples (65 per cent) in the region admit to not having made plans to ensure they will continue to receive an income in retirement, should they outlive their partner. Those in the Eastern region are the most savvy when it comes to financial planning, with nearly three quarters (72 per cent) claiming to have some arrangements in place.

Vince Smith-Hughes, retirement income expert at Prudential, said: “When a couple is planning for retirement, it is understandable that they would want to focus on the positives – like what they will use the extra time for.

“However, putting some time aside to discuss sensitive issues, like life after the death of your partner and the financial implications that it might have, is a vital part in ensuring the right financial arrangements are in place for the future. These conversations are especially important for those who are planning to rely on their partners for their retirement income.

“The changes to pensions and how people can access their retirement incomes announced in the Budget in March will provide savers and retirees with more choices. As a result, it has never been more important for couples to discuss their retirement planning arrangements. There is plenty of free information available on this issue from independent organisations such as The Pensions Advisory Service (TPAS), while a consultation with a financial adviser or retirement specialist will help many couples to plan more effectively together for the future.”

The study shows just one in five couples (20 per cent) have shared pension saving arrangements, while 65 per cent have their own individual arrangements. One in ten (11 per cent) have made a will but won’t have any other financial arrangements in place should they find themselves in this unfortunate situation.

For further information on how couples can successfully plan for retirement together and for Donna and Vince’s hints and tips on having the right conversations, please see our Couples’ Guide

Table One: Joint Retirement Arrangements

Escaping Debt & Poverty – new ebook guide

There’s no point in denying it; tens of millions of people are having their lives ruined by painful debt or poverty. One side-effect of this crippling affliction is the apparent lack of control and inability to stop further decline. Thankfully, philanthropist Tony U S Okwum has the answer, and it’s stupidly simple.

Everything is exposed in his new book, ‘Escaping From Debt & Poverty’, which opts for proven everyman strategies instead of official advice from the government and financial controllers who only have their best interests at heart. According to the book, poverty is a mindset and not a circumstance – and anyone now has the ability to finally understand money and its direct relation to life’s purpose.

Synopsis:

This is the right book for the right moment. This is the right book on a mission to change your life. For those who are perpetually in debt and experiencing heavy blows from money, this is the right book for you and for those who want to come out of poverty, this is for you.

Do you want to maximize what’s inside of you? Do you want to see your potential come to light? I strongly believe that this book will reshape and rebuild you to the real person you always wanted to be by overcoming financial debt and poverty.

Your greatest enemy in life is the wrong information that has settled in your subconscious mind which has made you to believe that you can never come out of debt and poverty. And this has almost made you to give up. In this book is the solution to that chronic problem- debt and poverty. The economist won’t educate you better and the government won’t tell you the truth, but this book will always lead you along the right path.

“The truth is that people already have everything they need inside of themselves; the key is to change their mind-sets and thought patterns surrounding money. They have to hate poverty enough to want to change it!” explains Okwum. “So-called professionals won’t be of any help, but my book will. Everything has been heavily tested and is unique as it has the readers’ best interests at heart. There’s nobody else trying to make money or pick up commission. That’s a rare thing these days.”

Continuing, “At the end of the day, it all comes down to control and if people want money to be their master or if they want to make it their servant. If someone’s money controls them, a simple shift in power is all that’s needed. When we change the old the new can come in to replace it, but the two can’t co-exist. The blueprint for doing just that is waiting. Become your own personal entrepreneur; if we all did it, the world would be a richer place.”

Readers agree, leaving positive reviews.

Sonia Andrews comments, “These days when everybody is hard hit financially. And the truth is that people just don’t know how to come out with solution and the government is not making it easier either. They are clueless. This book takes you into the world of financial reality. It’s straight to the point and blunt. This book is something you really need to have as an asset. Debt and poverty is crippling. This book is the real deal. It has highly enlightened and empowered me. Now I’m completely transformed after being trained and educated by this book. I can now recommend this book to anybody of any age. This little book has great power in it that can transform your financial life and affect your potential positively.”

Click on this image to buy the Kindle editiion at Amazon for only £1.99

Grass is not always greener in foreign climes, warns Foreign & Commonwealth Office

British nationals planning to retire abroad are being warned to learn more about their destination before moving by the Government’s Foreign & Commonwealth Office.

With six million British nationals planning to head overseas when they retire[1], the FCO is teaming up with popular TV programme ‘A Place in the Sun’ to urge UK retirees and others considering a move abroad to think long-term and plan thoroughly.

According to ‘A Place in the Sun’, there has been a swing back towards more established destinations since the global downturn, with Spain, Portugal and France proving to be particularly popular – both for buying a second home and full-time relocation. For many, moving to foreign climes to settle down in a place with warmer weather, different scenery and a change in lifestyle is an appealing prospect.

But there are many things to consider to help ensure a smooth transition. Despite the importance of being prepared before heading overseas, a recent survey2 has suggested that only a third of British nationals (32%) believe doing their own research is the most important thing to do before moving. Just one in ten (10%) saw their long-term financial requirements as the most important factor.

James Duddridge, Minister for Consular Affairs, said: “Moving abroad can be a wonderful experience, but living somewhere new is very different to your average holiday. It’s crucial to think about the future and allow plenty of time to do your research.

“A permanent or semi-permanent move overseas involves many practical and social changes. We would advise British nationals to take their time to research all aspects required for a successful move, such as the laws and customs of your future home country, the long-term financial implications for you and your family, any legal issues requiring independent advice and your current and future health needs. Remember, relocating is about more than bricks and mortar”.

Andy Bridge, Managing Director of A Place in the Sun, said: “It’s no coincidence that people who make the most successful transition abroad are those who are fully prepared and have done their research. Considering long-term financial requirements, learning the local language and seeking independent legal advice are just some of the important things you should think about. The FCO’s moving abroad checklist is a good place to start.’

Carole Hallett Mobbs, editor of ExpatChild.com, moved to South Africa over a year ago and comments: “I speak to British expats frequently, and often people forget simple, everyday steps such as cancelling their water back in the UK, which is a difficult task when you could be thousands of miles away. I would advise those looking to move abroad not to cut all financial ties with their home country when they move. Having a UK bank account left open can prove extremely useful when you discover an outstanding bill or utility needs sorting out, or in case of an emergency.”

Almost half (46%) of the survey respondents who already live abroad said their top piece of advice for those looking to relocate is to be realistic with their expectations. Hallett Mobbs echoes the sentiment: “Successful expats are those who go into their new life with their eyes open, and with a sense of adventure tempered by realism. The grass isn’t greener, it’s just different grass.”

The FCO can

The FCO cannot: [1] The MGM Advantage Survey, 2014 recently revealed that more than 6 million UK adults are planning to head overseas when they retire 2 Survey conducted by OnePoll in September 2014, from a nationally representative sample of 400 British residents overseas and 600 British nationals of retirement age looking to move overseas. 1 in 5 couples has no financial plan for retirementNew research from Prudential has found that couples in the UK are happy to talk about their money, but struggle to turn these conversations into concrete financial plans for the future. The annual survey, analysing attitudes to money and retirement planning among co-habiting couples aged 40 and over, found that nearly four in five couples (79 per cent) have discussed their finances in the last year, but more than half (52 per cent) admit that these conversations haven’t led to them agreeing a target figure for their joint retirement incomes. This figure rose to more than two thirds (67 per cent) among couples aged 45 to 54 – the crucial years in the lead-up to retirement. This failure to turn conversations about money into actual plans for the future is further demonstrated by the fact that although nearly three fifths (61 per cent) of couples over the age of 40 have discussed retirement planning in the last year, one in five (18 per cent) still admit to not knowing where their main source of retirement income will come from. Even more worrying is the fact that a quarter (25 per cent) of couples over the age of 40 have retirement funds that will only provide an income for life to an individual – rather than to their partners as well. Prudential’s research took place six months after the Chancellor of the Exchequer announced sweeping changes to pensions, savings and retirement income choices in the 2014 Budget. Three-quarters (74 per cent) of couples over the age of 40 said that they are aware of the changes, and 29 per cent of them have discussed the implications with their partners. However, despite this apparent awareness of the choices and opportunities now facing savers and retirees, only one in five (20 per cent) couples over the age of 40 say that one or both of them has consulted a financial adviser in the last five years, and only one in 10 (nine per cent) have had a joint meeting with their spouse and a professional adviser or retirement specialist. Meanwhile, the vast majority (70 per cent) of couples have never seen a financial adviser to discuss their retirement plans. Vince Smith-Hughes, retirement expert at Prudential, commented: “The gulf between those who are aware of retirement issues and recently announced Budget changes, and those who discuss the implications openly with their other halves is alarming. However, simply having conversations about money is not enough. Taking action always needs to be the next step. “For many couples, the first step to agreeing and securing a target income in retirement should be seeking professional financial advice together. As retirement becomes a more immediate prospect, a professional adviser or retirement specialist can help couples to make the right decisions about generating an income in retirement. “Independent organisations such as The Pensions Advisory Service (TPAS) provide information free-of-charge to couples who are embarking on those often tricky initial conversations about retirement planning.” Donna Dawson, psychologist and relationship expert says: “Although money appears to be a straightforward black and white issue about numbers, it is actually a very complex and emotional subject. Money discussions can often lead to disagreements between couples – misunderstandings, sulky silences and angry rows. “One way to reduce the emotional impact of financial discussions is to write things down, so that the options can be viewed by both partners objectively. Writing down the pros and cons of situations can help to clarify and contextualise the issues. Once couples start to discuss their finances, they should stick with the discussion until they find a solution – calling in a financial adviser if necessary.” Britain’s nation of holiday money hoardersAlmost half of us returning from holiday with foreign currency squirrel it away with a plan to use it for the next trip, rather than bother with the hassle of shopping around for the best exchange rates to convert it back into Sterling. This is according to a survey of over 2000 holidaymakers by ICE – International Currency Exchange, the leading travel money provider. • Almost 50% of UK travellers hoard holiday money at home Taking the pain out of organising currency conversions back into Sterling, the ICE Buy-Back service allows travellers with left over foreign currency, to get an exchange rate quote via text. According to the ICE survey, 49% of UK travellers come home with currency and do nothing with it. In contrast, only 3% give unspent local currency to charity, whilst 12% use it to tip hotel staff**. Just under a third convert their holiday money, when they get home, while the same proportion will fritter it in the airport lounge and gift shops. Only 16% would spend it on gifts for loved ones. Koko Sarkari, Chief Operating Officer of ICE, says, “Based on the national survey findings, we conducted a poll amongst our customers to find out how much foreign cash they are hoarding – 66% admitted to having over £50 worth of foreign currency at home**.” “If exchange rates were favourable when the currency was first ordered and another trip’s on the cards, you can understand why you wouldn’t rush to convert leftover holiday money back into Sterling. But with almost half of us hoarding foreign cash, the hassle factor probably plays a big part in the decision not to convert it back. At ICE, we completely understand this and that’s why we launched our text based buy-back service, providing a quick quote for any currency we sell – whether the customer ordered it from us or not. This hassle-free service means customers will know exactly what they will get and all they need do is pop in to one of our branches and complete the transaction. Customers should simply text SELL followed by the amount to 07786 207 053 and ICE will respond with a no obligation quote. *Source: ICE survey of 2,062 UK adults conducted by Consumer Intelligence 5-11 March 2014 Is your pension a mousetrap?Final salary pensioners are being urged to explore options to mitigate risks posed by the growing pension deficit threat, following reports of a potential cheese share-price war in the UK. The warnings from Reece Fallaize, Global Technical Adviser at deVere Group, one of the world’s largest independent advisory organisations, come after shares in Dairy Crest, makers of Cathedral City cheese, tumbled on Friday following reports that it could face increasingly strong competition from supermarket brands. Mr Fallaize explains: “To plug a blackhole in its pension scheme, last year Dairy Crest put £60m worth of cheese into the fund. Therefore, pension members maybe negatively affected should the market value of cheese fall. “Potentially, pension members may see the scheme’s funding decrease which in turn could lead the trustees of the scheme to make some amendments to members’ benefits to reduce the pension liabilities.” He continues: “This example of how a possible cheese price war could hit retirees’ income should offer a wake-up call for all members of final schemes. “Despite rising equity markets and global outlook looking relatively rosy, companies are still struggling to fund their pension schemes. “The pension deficits for FTSE 350 companies reached an all-time high of £113bn at end of May 2014. “It is important for pension members to understand exactly what represents a risk to their pensions and how these can be mitigated. “In the same way people have their cars regularly serviced, it is now more important than ever that individuals seek independent advice on an annual basis to ensure that they fully understand their pensions and how much they are likely to receive in retirement. “Regularly reviewing and taking action, where appropriate and possible to do so to keep on track with your financial planning strategy, will mean that you’re less likely to receive an unwelcome financial surprise when you come to retire.” Discover the secret laws of attraction – one day seminar in London

London: Internationally acclaimed Master Certified Coach and bestselling author, Talane Miedaner, knows the secrets to becoming a magnet to success – attracting the relationships, money and opportunities that you Find out at the SECRET LAWS OF ATTRACTION ONE DAY EVENT TAKING PLACE AT THE RITZ HTEL, LONDON ON SATURDAY 4TH OCTOBER. Miedaner’s approach draws on two powerful truths about human nature: “If you don’t NEED it, you are more likely to attract it” and “like attracts like.” Her famous 7-step program shows how to stop struggling and start going with the flow, how to expand your willingness to have your emotional needs fulfilled, how to orient your life around your core values and passions, how to indulge in excellent self-care and how to become effortlessly successful. These advanced life coaching techniques will help you reach your goals and attract whatever your heart desires – effortlessly. The old way of reaching goals was to create a strategy with a timeline and specific action steps. THE 7-STEP PROGRAM TO INCREASE YOUR POWER TO ATTRACT: 1. Increase your natural energy Based on the Principles of Attraction: v Like attracts like The Secret Laws of Attraction One Day Seminar in London costs £250.00 which includes a copy of the book, The Secret Laws of Attraction and luncheon. Places can be booked on line at www.uklifecoach.comor by calling 01395-271061. The timings for the day are 9am-4:30pm with book signing to follow. Delegates will be able to ask Talane any questions. About Talane Miedaner The Secret Laws of Attraction is led by Talane Miedaner, Master Certified Coach, founder of www.lifecoach.com and www.uklifecoach.com and international bestselling author of Coach Yourself to Success – 101 tips for reaching your goals at work and in life, McGraw-Hill.. A leader in the cutting-edge field of personal coaching, Talane is a sought-after international speaker and coaches executives of Fortune 500 companies, entrepreneurs and business owners around the world. She is also author of the audio program: Irresistible Attraction: a way of life and The Secret Laws of Attraction: the effortless way to get the relationship you want is published by McGraw-Hill.

|