Almost half of couples over the age of 40 have failed to make financial arrangements to ensure that their other halves will continue to receive an income on the death of their partner

Nearly 1 in 5 women plan to rely on their partners’ retirement savings

Just two in five (42 per cent) couples over the age of 40 in the UK have made arrangements to ensure that one partner will continue to receive a retirement income after the other dies, according to new research from Prudential1.

Almost half of couples over the age of 40 have failed to make financial arrangements to make sure that their other halves will continue to receive an income on the death of their partner

Women are most at risk, with nearly one in five (18 per cent) planning to depend entirely on their other halves for their retirement incomes, compared with just two per cent of men.

The insurer’s annual Couples’ Conversations study, which provides insights into the finances of co-habiting couples over the age of 40, also found that joint retirement planning discussions have declined over the past twelve months.

Nearly half (47 per cent) of couples have never discussed the impact that one partner’s death could have on their current pension arrangements – a 13 per cent increase since last year.

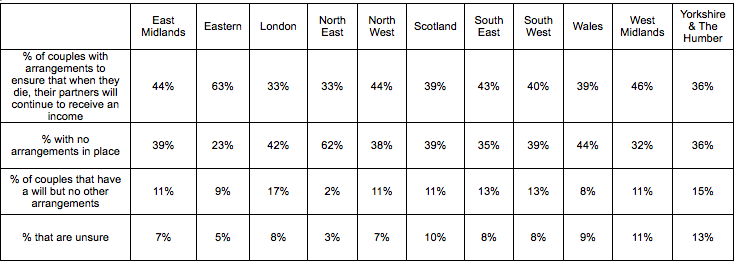

Couples in the North East are the least likely to have made joint retirement arrangements. Almost two thirds of couples (65 per cent) in the region admit to not having made plans to ensure they will continue to receive an income in retirement, should they outlive their partner. Those in the Eastern region are the most savvy when it comes to financial planning, with nearly three quarters (72 per cent) claiming to have some arrangements in place.

Vince Smith-Hughes, retirement income expert at Prudential, said: “When a couple is planning for retirement, it is understandable that they would want to focus on the positives – like what they will use the extra time for.

“However, putting some time aside to discuss sensitive issues, like life after the death of your partner and the financial implications that it might have, is a vital part in ensuring the right financial arrangements are in place for the future. These conversations are especially important for those who are planning to rely on their partners for their retirement income.

“The changes to pensions and how people can access their retirement incomes announced in the Budget in March will provide savers and retirees with more choices. As a result, it has never been more important for couples to discuss their retirement planning arrangements. There is plenty of free information available on this issue from independent organisations such as The Pensions Advisory Service (TPAS), while a consultation with a financial adviser or retirement specialist will help many couples to plan more effectively together for the future.”

The study shows just one in five couples (20 per cent) have shared pension saving arrangements, while 65 per cent have their own individual arrangements. One in ten (11 per cent) have made a will but won’t have any other financial arrangements in place should they find themselves in this unfortunate situation.

For further information on how couples can successfully plan for retirement together and for Donna and Vince’s hints and tips on having the right conversations, please see our Couples’ Guide

Table One: Joint Retirement Arrangements